Planning how to fund retirement is an issue facing many and it is exacerbated by the prospect of so many people living another 20, 30 or even 40 years after they have clocked off at work.

The pension freedoms may have created more options for retirees, but if clients have not saved enough to fund their later life plans, then they will be constrained in their choices.

Rupert Rucker, head of income solutions at Schroders, told FTAdviser why younger investors should be setting aside as much as 14 per cent of their income now if they want to retire comfortably.

He also believes there are plenty of income-yielding assets for investors to incorporate into their retirement income strategy.

Watch the full video interview below.

Dearth of client savings is biggest retirement income challenge

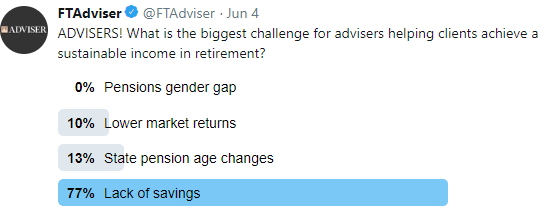

Lack of savings is the biggest challenge faced by advisers whose clients want a sustainable income in retirement.

This is according to the latest FTAdviser Talking Point poll, where 77 per cent of advisers cited not enough savings being an issue with retirement income.

This was followed by 13 per cent who thought state pension age changes were a barrier when it came to helping clients achieve an income throughout their later life.

Jaskarn Pawar, chartered financial planner at Investor Profile, said he was not surprised by the outcome of the poll.

Mr Pawar said: “The post-war mentality of financial prudence has well and truly gone.

“It is the good times now and people want to spend today without too much thought for tomorrow. The issue is that people don’t sit down and work out what their finances might look like over the long term.”

He added that auto-enrolment was “pretty much useless” if clients did not have a financial plan in place for their retirement, even with the higher contributions coming in.

The best option for someone to enjoy a sustainable income in retirement is to save as much as possible as early as possible, and then invest wisely.

“Contributing any amount to a pension is futile unless you know how much you need to be investing. What is the point in investing £50 per month if you should be investing £500 per month?” Mr Pawar pointed out.

Royal London’s Lorna Blyth previously told FTAdviser that those customers in drawdown may not continue to enjoy the strong market returns they have since the pension freedoms were introduced in 2015.

Only 10 per cent of advisers who voted in the poll said possible lower returns from stock markets were a potential challenge for clients wanting to achieve a sustainable retirement income.

Scott Charlish, a financial planner at Brewin Dolphin, said retirees can maximise their retirement savings by using some planning techniques.

“Firstly, consider how long the funds need to last and although annuities are out of favour compared to other options, they may still be useful for those who sadly face ill health in retirement,” he explained.

“Also, look at the savings held and determine if any capital gains exist which can be managed over a period of time rather than forcing a single sale, which triggers a tax that otherwise might be avoided.”

Rachel Vahey, product technical manager at Nucleus, added: “Of course, the best option for someone to enjoy a sustainable income in retirement is to save as much as possible as early as possible, and then invest wisely.”

The pensions gender gap has widened in recent years, yet none of the advisers who took part in the poll said this was an issue when it came to ensuring their clients achieved a sustainable income in later life.

According to data from Royal London, in 2016 to 2017 the gap between men and women in terms of gross income was £85 per week, up from £31 a week 10 years earlier.

eleanor.duncan@ft.com

House View: Lesley-Anne Morgan, Schroders' head of retirement, on the state of retirement savings

Our annual Global Investor Study (GIS) has revealed that investors are saving an average 11.4 per cent of their salary specifically for retirement.

However, the research, which covered 30 countries, also found two-thirds of retired investors wished they had put away more.

The study surveyed more than 22,000 individual investors and found the proportions of income saved for retirement were highest in Asia, at 13 per cent, and weakest in Europe, at 9.9 per cent.

In the Americas, the average investor saved 12.5 per cent of their income.

It’s well known that people aren’t saving enough for retirement but this study shows that even those who are already established investors are not putting away enough money.

To reach their goals, people will need to save even more than savers did in previous generations.

There’s also a strong message from those who have already saved: "I wish I had saved more."

The pension savings gap is further compounded by the fact we’re in an age of low rates and low returns. To reach their goals, people will need to save even more than savers did in previous generations.

The study shows investors globally are only putting away 11.4 per cent of their income but say they want to retire at 60.

Our analysis shows that someone who started saving for retirement at age 30 is likely to need savings of at least 14 per cent a year if they wanted to retire on 50 per cent of their salary.

The level of retirement income savers can expect depends on:

• The amount contributed (and when).

• The returns achieved.

• How the money is invested after retirement.

• The length of time over which money will be withdrawn.

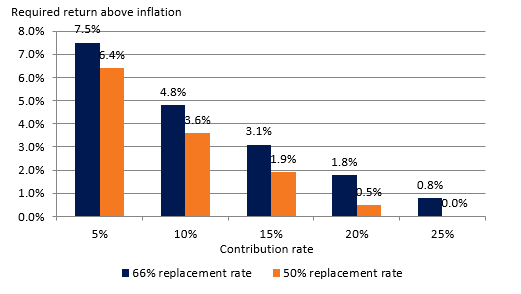

The chart below sets out analysis undertaken by my team.

It assumes a starting age of 30 with an average national salary of £27,000 that rises in line with inflation.

It shows the real annual returns – where inflation is taken account – that would be needed to achieve two levels of income: 50 per cent or 66 per cent of your salary when you retire. These are typical bands that people aim for.

It also assumes they will draw on the money for 18 years, on average.

How much savers need to save, depending on returns achieved

Source: Schroders Retirement. For illustrations only. Starting age 30 years, retiring at 65. Starting salary of £27,000 assumed to grow at the rate of inflation. Replacement rate based on current annuity rates generating an income of 66 per cent and 50 per cent of final salary respectively.

So if a saver contributed 15 per cent of their income, they would require an average annual real return of 1.9 per cent (the middle column) to achieve a retirement income worth 50 per cent of their income.

If they contributed 10 per cent of income, however, they would need a return of 3.6 per cent.

Past performance offers no guarantee of future returns, but today’s low-rate world could mean investments pay less than they have done in recent decades.

However, the Schroders Global Investor Study also found respondents remained optimistic about the outlook for returns.

Globally, investors anticipated their investments would return 10.2 per cent a year over the next five years. If inflation were taken into account, this would equate to a real return expectation of around 8 per cent.

Start saving at an early age and it makes an incredible difference to the eventual size of your retirement account.

Returns are also influenced by how much risk is taken with a portfolio, which in turn dictates the type of assets that are bought.

However, the study also found that investors are currently averse to taking too much risk due to the uncertainty caused by international events.

• 59 per cent do not want to take on as much risk in their investments now.

• 48 per cent have put more money in cash than they had before.

People in some countries tend to invest more cautiously and may therefore see lower returns. In Germany, for instance, pension savers have a preference for bonds, which typically have delivered lower returns.

Such savers will need to contribute even more to ensure they realise their retirement goals.

The most powerful tool available to savers is time. Start saving at an early age and it makes an incredible difference to the eventual size of your retirement account. The miracle of compounding, where you earn returns on your returns, adds up over 30 or 40 years of saving.

Important information: Schroders commissioned Research Plus Ltd to conduct, between 1 and 30 June 2017, an independent online study of 22,100 people in 30 countries around the world, including Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, the Netherlands, Spain, UAE, the UK and the US. This research defines “people” as those who will be investing at least €10,000 (or the equivalent) in the next 12 months and who have made changes to their investments within the last 10 years.